Analytics in Banking

Customer Profiling, Credit Scoring, and Use Cases Agenda

1 Introduction Analytics in Banking

2 Customer Profiling in Banking

3 Credit Scoring in Banking

4 Data Analytics Tools in Banking

5 Challenges in Banking Analytics

6 Customer Segmentation Strategies

7 Fraud Detection and Prevention

8 Trends in Banking Analytics

9 Predictive Analytics Applications

10 Use Cases in Banking Analytics

11 Ethical Considerations in Banking Analytics

Conclusion

Leveraging Analytics for Competitive Advantage in Banking

Introduction Analytics in Banking

Importance of Analytics in Banking

Analytics in banking is crucial for making data-driven decisions, improving operational efficiency, understanding customer behavior, and managing risks effectively.

Use Cases of Analytics in Banking

Analytics is used in banking for fraud detection, customer segmentation, personalized marketing, risk management, and optimizing operational processes.

Customer Profiling

Analyzing customer data to create detailed profiles that segment customers based on demographics, behavior, preferences, and financial habits, allowing for personalized services and targeted marketing campaigns.

Credit Scoring

The process of evaluating a borrower’s creditworthiness based on various financial factors to determine the likelihood of default, enabling banks to make informed lending decisions and manage credit risk effectively.

Analytics plays a vital role in banking by enabling informed decision-making, improving customer experiences, and driving operational efficiency. Customer profiling and credit scoring are key applications of analytics in the banking sector, allowing for personalized services and effective risk management.

Customer Profiling in Banking

• Definition of Customer Profiling

Customer profiling in banking involves gathering and analyzing customer data to create detailed customer profiles that help in understanding customer behavior, preferences, and needs for targeted marketing and personalized services.

- Importance of Customer Profiling

Customer profiling is essential for banks to tailor their products and services to meet individual customer needs, enhance customer relationships, increase customer satisfaction, and drive profitability through targeted marketing strategies.

- Data Sources for Customer Profiling

Customer data for profiling can be sourced from transaction histories, social media interactions, demographic information, purchase behaviors, and customer feedback, allowing banks to create comprehensive customer profiles.

• Techniques for Customer Profiling

Techniques such as clustering, regression analysis, and machine learning algorithms are employed to segment customers based on similarities, behavior patterns, and preferences, enabling banks to personalize services and marketing campaigns effectively.

Customer profiling is a strategic approach in banking that involves analyzing customer data to gain insights into customer behavior and preferences. By leveraging data sources and advanced techniques, banks can create detailed customer profiles for targeted marketing and personalized services.

Credit Scoring in Banking

• Purpose of Credit Scoring

Credit scoring in banking is used to assess the creditworthiness of borrowers, predict their likelihood of default, and determine the risk associated with lending money, enabling banks to make informed lending decisions.

- Models for Credit Scoring

Banks use statistical models such as logistic regression, decision trees, and neural networks to build credit scoring models that evaluate various financial factors and assign credit scores to borrowers based on their risk profiles.

• Factors Considered in Credit Scoring

Credit scoring models consider factors like credit history, debt-to-income ratio, payment history, new credit accounts, and credit utilization to assess the borrower’s credit risk and determine their credit worthiness.

IMAGE

- Impact of Credit Scoring on Lending

Effective credit scoring improves the accuracy of lending decisions, reduces the risk of defaults, helps in setting appropriate interest rates, and enables banks to offer credit products tailored to individual risk profiles Credit scoring is a critical process in banking that helps in evaluating the creditworthiness of borrowers and managing credit risk effectively. By utilizing sophisticated models and considering key financial factors, banks can make well-informed lending decisions and optimize their lending practices.

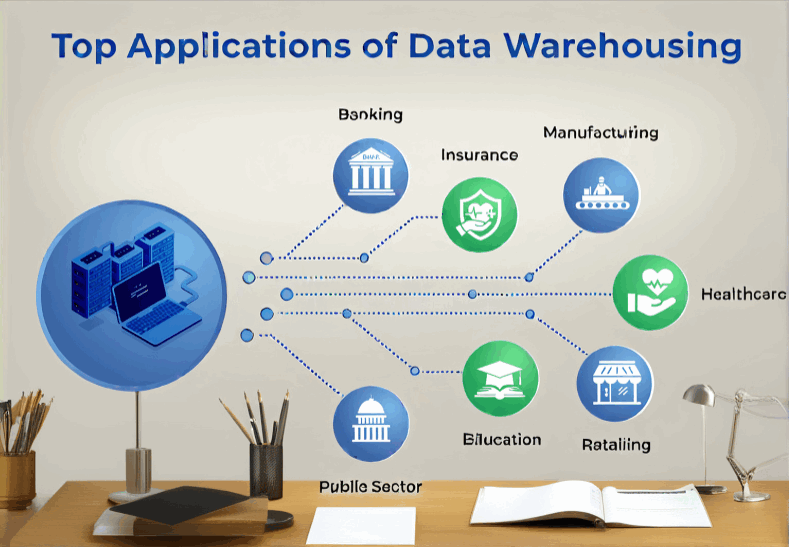

Data Analytics Tools in Banking

• Usage of Tools

Banks utilize a variety of data analytics tools to process, analyse, and interpret large volumes of financial data for decision-making and strategic planning

• Statistical Models

Statistical models in banking help in identifying patterns and trends in data, enabling better risk assessment, fraud detection, and performance evaluation

• Machine Learning

Machine learning algorithms are employed in banking for tasks like credit risk assessment, customer segmentation, and personalized product recommendations based on historical data patterns

IMAGE

- Predictive Analytics

Predictive analytics in banking uses historical data combined with statistical algorithms to forecast future trends, customer behaviour, and potential risks, aiding in proactive decision-making Data analytics tools play a crucial role in banking operations, offering insights into customer behavior, market trends, and risk management. Banks leverage statistical models, machine learning algorithms, and predictive analytics to make informed decisions and enhance overall performance.

Challenges in Banking Analytics

•Data Security

Ensuring the confidentiality, integrity, and availability of sensitive financial data to protect against cyber threats, unauthorized access, and data breaches

•Regulatory Compliance

Compliance with financial regulations and standards, such as GDPR and Basel III, to ensure transparency, accountability, and ethical data practices within the banking industry

• Data Quality

Maintaining accurate, complete, and reliable data sources to support informed decision making and prevent errors or biases in analytical outcomes

IMAGE

•Interpretation of Results

Effectively analysing and interpreting data insights to derive actionable recommendations, optimize strategies, and drive business growth in the competitive banking sector Banking analytics faces challenges related to data security, regulatory compliance, data quality, and interpretation of results. Addressing these challenges is essential for leveraging analytics effectively and gaining a competitive edge in the market.

Customer Segmentation Strategies

• Benefits of Segmentation

Segmenting customers allows banks to tailor products and services, enhance customer experience, increase retention rates, and improve marketing ROI through targeted campaigns

• Approaches to Segmentation

Utilizing demographic, behavioural, psychographic, and geographic data to categorize customers into distinct segments based on common characteristics, preferences, and needs

• Targeted Marketing

Developing customized marketing strategies and communication channels to reach specific customer segments with relevant and personalized content, offers, and promotions

- Personalization

Delivering personalized banking experiences, product recommendations, and services based on individual customer data and behaviors to foster loyalty and satisfaction

IMAGE

Customer segmentation strategies in banking offer numerous benefits, such as improved customer engagement, targeted marketing, and personalized experiences. By categorizing customers into segments and applying targeted marketing approaches, banks can enhance customer satisfaction and retention.

Fraud Detection and Prevention

• Fraud Detection Techniques

Utilizing advanced analytics, machine learning algorithms, and anomaly detection to identify unusual patterns, suspicious activities, and potential fraud in banking transactions

• Real-time Monitoring:

Implementing real-time monitoring systems and alerts to proactively detect and prevent fraudulent activities, unauthorized access, and security breaches in banking operations

• Case Studies

Exploring real-life examples and scenarios of successful fraud detection and prevention strategies implemented by banks to safeguard customer assets and maintain trust in financial services

•Impact on Operations

Effective fraud detection and prevention measures not only protect against financial losses but also enhance operational efficiency, customer trust, and regulatory compliance in the banking sector

IMAGE

Fraud detection and prevention are critical aspects of banking analytics, safeguarding financial institutions and customers from fraudulent activities. By employing advanced techniques and real-time monitoring, banks can mitigate risks, protect assets, and maintain operational integrity.

Trends in Banking Analytics

• AI Integration

Integrating artificial intelligence technologies like chatbots, predictive analytics, and sentiment analysis to automate processes, enhance customer interactions, and optimize decision-making in banking operations

• Blockchain Technology

Implementing blockchain for secure and transparent transactions, smart contracts, identity verification, and data integrity to revolutionize traditional banking practices and improve efficiency

• Big Data Analytics

Leveraging big data analytics tools and techniques to process large volumes of structured and unstructured data, extract insights, and drive strategic initiatives for personalized services and operational improvements

IMAGE

• Customer Experience Enhancement

Prioritizing customer centric approaches, user-friendly interfaces, and personalized services to deliver seamless banking experiences, build trust, and foster long-term customer relationships Emerging trends in banking analytics include the integration of Al, blockchain technology, big data analytics, and customer experience enhancement. By embracing these trends, banks can streamline operations, enhance security, and improve customer satisfaction.

Predictive Analytics Applications

•Risk Management

Using predictive analytics to assess credit risk, detect fraudulent activities, and optimize loan approval processes to mitigate financial risks and ensure regulatory compliance in banking operations

•Cross-selling and Upselling

Employing predictive analytics to analyze customer behavior, identify cross-selling and upselling opportunities, and personalize product recommendations to increase revenue and deepen customer relationships

•Customer Retention

Utilizing predictive analytics to predict customer churn, implement retention strategies, personalize offers, and improve customer satisfaction to enhance loyalty and reduce attrition in the competitive banking market

IMAGE

Predictive analytics applications in banking span across risk management, cross-selling, upselling, and customer retention strategies. By leveraging predictive modeling techniques, banks can optimize operations, drive revenue growth, and enhance customer relationships.

Use Cases in Banking Analytics

Customer Lifetime Value Prediction

Predicting the long-term value of customers, segmenting high-value customers, personalizing

interactions, and implementing retention strategies to improve profitability and enhance customer relationships in the banking sector

Loan Approval Optimization

Utilizing analytics to assess creditworthiness, automate loan approval processes, optimize interest rates, and reduce risks for both banks and borrowers, ensuring efficient and fair lending practices

Marketing Campaign

Effectiveness

Measuring the impact of marketing campaigns, analyzing customer responses, optimizing targeting strategies, and maximizing ROI through datadriven insights and predictive analytics in banking marketing initiatives

By leveraging analytics, banks can streamline processes, improve customer engagement, and drive business growth.

Ethical Considerations in Banking Analytics

Privacy Concerns

Addressing data privacy issues, ensuring consent, protecting sensitive information, and complying with regulations to maintain customer trust and data security in banking analytics practices

Bias Mitigation

Identifying and mitigating biases in data collection, model development, and decision-making processes to ensure fairness, equity, and ethical practices in banking analytics applications

Transparency in Algorithms

Promoting transparency in algorithmic decision-making processes, disclosing data usage practices, and providing explanations for automated decisions to build trust and accountability in banking analytics operations

Fairness in Decision Making

Ensuring fairness in lending practices, credit assessments, and customer interactions by avoiding discriminatory practices, biases, and unethical decision-making criteria in banking analytics initiatives

Ethical considerations in banking analytics encompass privacy, bias mitigation, transparency, and fairness in decision-making. Upholding ethical standards and regulatory compliance is crucial for building trust, mitigating risks, and fostering integrity in banking analytics.

Conclusion

Leveraging Analytics for Competitive Advantage in Banking

Future Outlook

The future of analytics in banking involves advanced technologies, data-driven decision-making, customer experience enhancement, and regulatory compliance to drive innovation, business transformation, and industry leadership

Key Takeaways

Leveraging analytics in banking offers strategic insights, operational efficiencies, and customer-centric solutions for competitive advantage, market differentiation, and sustainable growth in the financial industry

Recommendations

Strategies for banks to optimize analytics investments, prioritize

data governance, foster a culture of data-driven decision-making, and embrace emerging trends for sustainable growth and competitive edge in today’s dynamic banking landscape In conclusion, leveraging analytics in banking is essential for gaining a competitive advantage, driving innovation, and achieving sustainable growth. By embracing data-driven strategies, fostering innovation, and prioritizing customer-centric solutions, banks can position themselves as

industry leaders and adapt to evolving market demands.