Insurance Data Analytics and Data Warehouse: A Comprehensive Guide

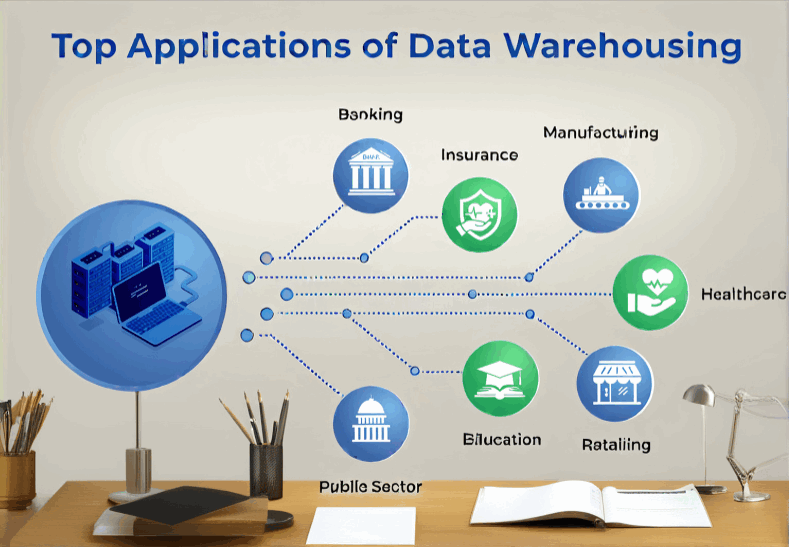

In the age of digital transformation, the insurance industry is heavily leveraging data analytics to optimize operations, enhance customer experiences, and manage risks more effectively. One key component of this transformation is the use of a data warehouse. This article explores the critical role of data warehouses in insurance data analytics, explains how to create one, highlights the common platforms, databases, and languages used, and compares data warehouses with data lakes.

What is a Data Warehouse?

A data warehouse is a centralized repository designed to store large volumes of structured data collected from various sources. It allows for the efficient querying and analysis of this data, often supporting business intelligence (BI) operations such as reporting, forecasting, and decision-making.

A data warehouse collects data over time, making it a valuable asset for the insurance sector, where historical data is critical for risk assessment, fraud detection, and policy pricing.

Why Do We Need a Data Warehouse?

In the insurance industry, data comes from multiple sources such as claims management systems, customer relationship management (CRM) platforms, underwriting applications, and third-party sources (credit scores, health records, etc.). A data warehouse helps to:

- Centralize disparate data A data warehouse consolidates data from various systems into one platform, making it easier to manage and analyze.

- Improve data quality By cleaning and standardizing data, a data warehouse ensures accuracy and consistency.

- Enhance reporting Insurers can generate detailed reports that provide insights into customer behavior, claims trends, and financial performance.

- Support regulatory compliance The insurance industry is highly regulated. A data warehouse helps companies meet reporting requirements by storing accurate and auditable data.

How to Create a Data Warehouse

Building a data warehouse involves several steps:

- Identify the business requirements Define the scope of the data warehouse by understanding the key performance indicators (KPIs) and business intelligence needs of the insurance company.

- Choose the right data sources Identify which data sources will feed into the warehouse. These could include transactional systems (policy management systems), external data sources (credit bureaus), and data from partners.

- Design the data model Data should be organized in a schema that supports efficient querying. Insurance companies often use a star or snowflake schema, where a central fact table is connected to multiple dimension tables.

- Extract, Transform, Load (ETL) process The ETL process involves extracting data from source systems, transforming it into the desired format, and loading it into the data warehouse.

- Select the right platform and tools Choose the database and tools that fit your business requirements. Some of the most popular platforms for building data warehouses include AWS Redshift, Google BigQuery, and Microsoft Azure SQL Data Warehouse.

- Test and deploy Once the data warehouse is built, it needs to be tested to ensure that it meets performance and accuracy standards before deployment.

Common Platforms, Databases, and Languages

- Platforms

- Amazon Redshift A fully managed data warehouse service that supports large-scale data storage and analysis.

- Google BigQuery A serverless data warehouse platform designed for large datasets and fast querying.

- Microsoft Azure SQL Data Warehouse A scalable cloud data warehouse service.

- Snowflake A popular cloud-based data warehousing platform offering scalable storage and performance.

- Databases

- PostgreSQL Known for its reliability, PostgreSQL is often used in data warehousing applications.

- Oracle Oracle’s data warehouse solutions are widely adopted in industries that require high performance and availability.

- SQL Server Microsoft’s SQL Server provides comprehensive data warehousing functionality.

- Languages

- SQL (Structured Query Language): The primary language for querying data in a data warehouse.

- Python: Often used for data transformation and advanced analytics.

- R: Used for statistical analysis and visualization.

Benefits of a Data Warehouse for Insurance Data Analytics

- Faster decision-making A data warehouse enables insurers to quickly access and analyze data, resulting in faster, data-driven decision-making.

- Improved risk management Insurers can analyze claims histories and predict potential risks with greater accuracy.

- Fraud detection By analyzing large datasets, a data warehouse helps insurers identify anomalies that may indicate fraudulent activity.

- Enhanced customer insights Insurers can analyze policyholder data to offer personalized products and services.

- Regulatory compliance A data warehouse ensures that insurers can easily generate accurate reports required by regulators.

When Do We Need a Data Warehouse?

A data warehouse is essential in several scenarios:

- Historical data analysis When you need to analyze trends over time, a data warehouse provides the historical context that transactional systems cannot offer.

- Complex reporting When reports require data from multiple systems (claims, customer data, financials), a data warehouse enables consolidated reporting.

- Data integration When the company deals with multiple sources of data, such as claims data, customer service logs, and external market data, integrating these into a data warehouse facilitates comprehensive analysis.

- Regulatory reporting For insurers that need to comply with complex regulatory reporting requirements, a data warehouse ensures the accuracy and completeness of reports.

Comparing Data Warehouse and Data Lake

The difference between a data warehouse and a data lake is crucial to understand in the context of insurance analytics. Here is a comparison table that outlines the key distinctions:

| Feature | Data Warehouse | Data Lake |

|---|---|---|

| Data Type | Structured | Unstructured, semi-structured, and structured |

| Purpose | Optimized for reporting and analytics | Primarily for big data analytics and ML |

| Data Storage | Stored in tables with defined schemas | Stores raw data in any format (JSON, CSV, etc.) |

| Performance | High performance for complex queries | May require preprocessing for high performance |

| Cost | More expensive due to structured data storage | Generally more cost-effective |

| User | Business analysts, decision-makers | Data scientists, analysts |

| ETL Process | ETL is typically required before loading | ELT (Extract, Load, Transform) allows for on-demand transformation |

| Use Case | Reporting, historical analysis, compliance | Advanced analytics, machine learning, big data |

| Technology | SQL, relational databases | Hadoop, NoSQL, distributed computing |

Why Choosing the Right Solution is Important

Selecting between a data warehouse and a data lake depends on the specific needs of the insurance company. Data lakes offer flexibility for unstructured data and advanced analytics but require expertise to manage the complexity of raw data. Data warehouses, on the other hand, provide structured, processed data that is optimized for reporting and decision-making.

However, with the growing complexity of insurance data, many organizations are adopting a hybrid approach, known as the Lakehouse Architecture, which combines the strengths of both data warehouses and data lakes. This allows insurance companies to handle structured and unstructured data more efficiently, providing a unified platform for data storage and analysis.

Important Considerations for Insurance Companies

As insurance companies continue to digitize, their success depends on how well they can manage and leverage data. Here are some key considerations for insurers looking to implement a data warehouse:

- Scalability As data volumes grow, it’s crucial to ensure that the data warehouse can scale to accommodate future demands.

- Data security The insurance industry handles sensitive customer data, making robust security measures essential. Implementing strong encryption, access controls, and audit trails within the data warehouse is critical.

- Integration with AI/ML With the rise of AI and machine learning in insurance, the data warehouse should support integration with advanced analytics tools to drive innovation in risk modeling, fraud detection, and customer insights.

- Vendor selection Choosing the right vendor for your data warehouse solution is important. Consider factors such as ease of use, pricing, and support for cloud and on-premise implementations.

- Compliance Ensure that the data warehouse adheres to the regulatory standards required in the insurance industry, including GDPR, HIPAA, and others.

Conclusion

Data warehouses play a pivotal role in transforming the way insurance companies manage and analyze data. By centralizing structured data and making it accessible for analysis and reporting, insurers can make informed decisions, optimize operations, and stay competitive in a rapidly changing industry. Whether you’re building a data warehouse from scratch or considering the benefits of a hybrid data lakehouse approach, investing in a robust data infrastructure is essential for long-term success in the insurance industry.