What is Dynamic Pricing?

Xquisite AI is Data And AI company that have many use case, one of them is Dynamic Pricing.

Dynamic Pricing is a pricing system that set product or services price according to certain parameters.

the price can go up and down according to situation, such as supply and demand, competitor price, season or time, and also stock/inventory level.

example :

Airplane ticket price is adjusted if competitors is using cheaper or more expensive price for the same route, if competitors price is cheaper, we want our price also as cheap or even lower than the competitor price to attract customers to buy our tickets. this is Dynamic pricing according to competitor pricing, its very common in airlines industry.

there is also dynamic pricing for supply and demand, if certain route have many customers interested to book a flight, the airlines can use this as an opportunity to increase pricing, because the ticket is limited.

there is also dynamic pricing according to time, if customer want to book todays flight that is scheduled to depart by the same day, the price can be increased because the customer need this flight. and on the contrary if customers book flight for next month, the pricing can be lowered because booking far ahead for a flight the demand is not as high as immediate flight booking.

There is many types, variable and parameter that can be used to decide dynamic pricing for products and services. this will depend on company, industry and customers where they want to implement dynamic pricing.

The Advantage of dynamic pricing

there is many advantage in dynamic pricing, here are some :

1. Maximized Revenue and Profits

By adjusting prices based on demand, businesses can maximize their revenue and profit margins. During high demand periods, prices can be increased, while during low demand periods, prices can be lowered to attract more customers.

2. Improved Inventory Management

Dynamic pricing helps in better inventory management by aligning prices with inventory levels. It can reduce the risk of overstocking or stockouts, ensuring a more balanced supply and demand.

3. Enhanced Competitiveness

Businesses can remain competitive by adjusting their prices in real-time to match or beat competitors. This responsiveness can attract price-sensitive customers and maintain market share.

4. Customer Segmentation

It allows businesses to segment customers based on their willingness to pay. By analyzing purchasing behavior and price sensitivity, businesses can offer personalized pricing to different customer segments, increasing customer satisfaction and loyalty.

5. Market Trend Adaptation

Dynamic pricing enables businesses to quickly adapt to market trends and changes. Whether it’s a new competitor entering the market or a sudden increase in raw material costs, businesses can adjust prices to maintain profitability.

6. Optimal Resource Utilization

It helps in the optimal utilization of resources by adjusting prices to balance demand and supply. For example, in the travel and hospitality industry, dynamic pricing can ensure maximum occupancy and utilization of services.

7. Increased Sales Volume

By offering lower prices during off-peak times or for products with lower demand, businesses can increase sales volume and attract more customers, leading to higher overall revenue.

8. Data-Driven Decision Making

The use of advanced algorithms and data analytics in dynamic pricing provides businesses with valuable insights into customer behavior, market trends, and pricing strategies. This data-driven approach leads to more informed and effective pricing decisions.

Dynamic pricing can be a powerful tool for businesses looking to optimize their pricing strategy, improve profitability, and stay competitive in a dynamic market environment.

What industry can use dynamic pricing?

Almost any industry can use dynamic pricing, But Most common industry that use this type of pricing is :

- Retail

Online and brick-and-mortar retailers use dynamic pricing to adjust prices based on demand, competitor pricing, inventory levels, and seasonal trends. E-commerce giants like Amazon are known for their dynamic pricing strategies.

- Travel and Hospitality

Airlines, hotels, car rental companies, and travel agencies frequently use dynamic pricing to adjust prices based on demand, booking time, and availability. This helps in maximizing occupancy and revenue during peak and off-peak periods.

- Entertainment and Sports

Event organizers, concert venues, and sports teams use dynamic pricing to set ticket prices based on demand, seating availability, and event popularity. This ensures optimal ticket sales and revenue generation.

- Transportation and Ride-Sharing

Companies like Uber and Lyft use dynamic pricing, often referred to as surge pricing, to adjust fares based on demand, traffic conditions, and driver availability. This helps in balancing supply and demand in real-time.

- Utilities and Energy

Utility companies use dynamic pricing to manage electricity demand and supply. Time-of-use pricing, for example, charges customers different rates based on the time of day, encouraging energy consumption during off-peak hours.

- E-commerce

Online marketplaces and platforms use dynamic pricing to adjust product prices based on factors such as customer behavior, competitor pricing, and inventory levels. This strategy helps in maximizing sales and customer satisfaction.

- Real Estate

Property rental platforms, such as Airbnb, use dynamic pricing to adjust rental rates based on factors like location, season, local events, and property demand. This helps property owners maximize their rental income.

- Telecommunications

Telecom companies use dynamic pricing to offer different pricing plans based on usage patterns, customer segments, and competitive offers. This helps in attracting and retaining customers.

- Grocery and Food Delivery

Supermarkets and food delivery services use dynamic pricing to adjust prices based on demand, perishability of products, and supply chain factors. This ensures optimal inventory management and reduces waste.

- Automotive

Car dealerships and rental services use dynamic pricing to adjust vehicle prices based on demand, market conditions, and inventory levels. This helps in maximizing sales and rental revenue.

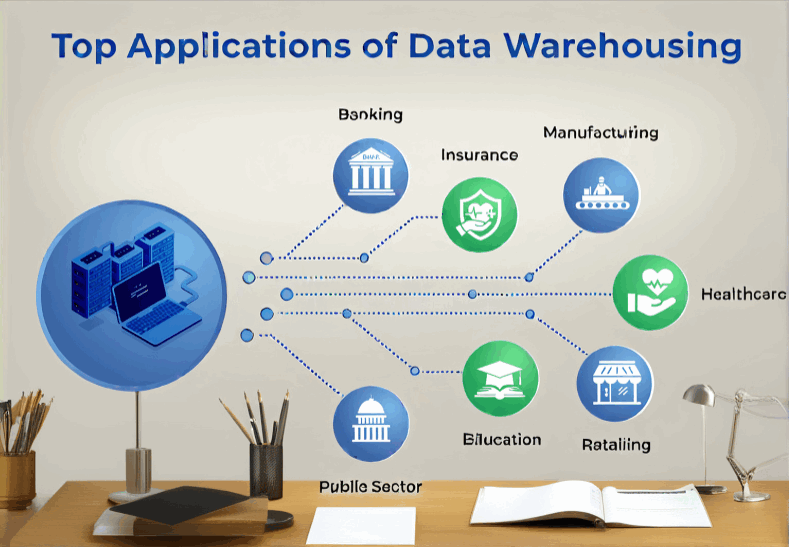

- Insurance

Insurance companies use dynamic pricing to set premiums based on risk factors, customer profiles, and market conditions. This helps in offering competitive rates while managing risk effectively.

- Banking and Financial Services

Financial institutions use dynamic pricing to offer different interest rates, fees, and product pricing based on customer risk profiles, market conditions, and competitive offers. This helps in optimizing profitability and customer acquisition

We at Xquisite can help you get started on implementing Dynamic pricing for your company products & Services.

with our experience, we can guide you step by step in preparing all the necessary data, parameters, platform, infrastructure, technology that will be used.

our consultant is ready to help you starting from preparing the big data and machine learning also data acquisition and data crawling to support you in this incredible project.

making sure you are in the right way in using dynamic pricing to your advantage.

The Disadvantage of dynamic pricing

while we can support you in creating dynamic pricing, we need you to also understand that there is disadvantages of using dynamic pricing, here is something that you need to consider before going with dynamic pricing

While dynamic pricing offers many advantages, it also has several potential disadvantages that businesses need to consider:

1. Customer Dissatisfaction

Frequent price changes can lead to customer dissatisfaction and a perception of unfairness. Customers may feel they are being taken advantage of, especially if they see prices fluctuate significantly within a short period.

2. Complexity and Costs

Implementing dynamic pricing requires sophisticated algorithms, real-time data analytics, and continuous monitoring, which can be complex and costly. Smaller businesses may find it challenging to invest in the necessary technology and expertise.

3. Loss of Trust and Loyalty

Inconsistent pricing can erode customer trust and loyalty. If customers believe they are not getting the best deal or that prices are arbitrary, they may choose to shop elsewhere.

4. Competitive Backlash

Aggressive dynamic pricing strategies can lead to price wars with competitors, resulting in a race to the bottom that can erode profit margins for all players in the market.

5. Legal and Ethical Concerns

In some regions, dynamic pricing can raise legal and ethical concerns, especially if it leads to price discrimination or violates consumer protection laws. Businesses must navigate regulatory environments carefully.

6. Negative Publicity

Instances of extreme price surges, such as during emergencies or high-demand situations, can attract negative publicity and harm a company’s reputation. For example, ride-sharing companies have faced backlash for surge pricing during natural disasters.

7. Customer Confusion

Constantly changing prices can confuse customers, making it difficult for them to make purchasing decisions. This can lead to frustration and abandoned shopping carts in e-commerce settings.

8. Inaccurate Pricing Models

Dynamic pricing relies heavily on accurate data and predictive models. If the data is flawed or the models are not well-calibrated, it can lead to pricing errors that harm sales and profitability.

9. Short-Term Focus

Over-reliance on dynamic pricing can lead businesses to focus too much on short-term gains rather than long-term customer relationships and brand loyalty. This can be detrimental in industries where customer retention is critical.

10. Operational Challenges

Implementing dynamic pricing requires changes in operational processes, including updating pricing systems, training staff, and managing customer communications. These changes can be resource-intensive and disruptive.

11. Market Saturation

In highly competitive markets, the widespread use of dynamic pricing can lead to saturation, where all competitors are continuously adjusting prices, making it difficult to achieve a competitive edge.

12. Impact on Brand Perception

Frequent price fluctuations can impact brand perception, making a brand appear unstable or unreliable. Premium brands, in particular, may suffer from a dynamic pricing approach that contradicts their image of exclusivity and stability.

Businesses need to weigh these disadvantages against the potential benefits and consider how to implement dynamic pricing strategies in a way that minimizes negative impacts while maximizing positive outcomes.