Xquisite AI is the best Company Working in Data Analytics and AI field

Xqusite AI started in 2016, our office based in Jakarta Indonesia, we are working with Enterprise companies in building data warehouse and their analytics capabilities.

we’ve fervently empowered enterprises with advanced data analytics, propelling business growth through innovative initiatives.

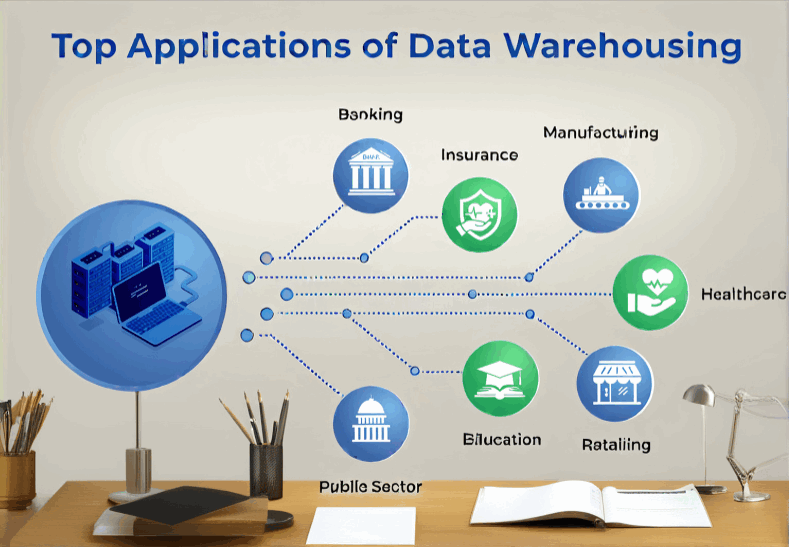

Our proven success across diverse industries underscores our commitment to driving insights and transforming businesses into data-driven leaders.

we have reached Gold Partnership with Microsoft at some point in data analytics, we are also a close partner with AWS, Google Cloud Platform and Alibaba Cloud.

Some of the things we do for Data analytics solutions in jakarta, Indonesia :

- Fraud Detection and Prevention: Banks use data analytics to identify patterns and anomalies in transactions to detect potential fraud in real-time. Advanced analytics techniques, such as machine learning algorithms, help improve accuracy and reduce false positives.

- Customer Segmentation: By analyzing customer data, banks can segment their customer base into groups based on demographics, behavior, and preferences. This segmentation allows for targeted marketing campaigns, personalized product offerings, and improved customer satisfaction.

- Credit Risk Assessment: Data analytics plays a crucial role in assessing the creditworthiness of loan applicants. Banks analyze various factors, including credit history, income, employment status, and other financial indicators, to determine the risk associated with lending to a particular individual or business.

- Churn Prediction: Banks use predictive analytics to identify customers who are at risk of leaving or “churning” to a competitor. By analyzing historical customer data and behavior patterns, banks can proactively engage at-risk customers with targeted retention strategies.

- Cross-Selling and Upselling: Data analytics enables banks to identify opportunities for cross-selling and upselling additional products or services to existing customers. By analyzing customer transaction history and behavior, banks can offer personalized recommendations tailored to individual needs and preferences.

- Branch Optimization: Banks use analytics to optimize their branch network by analyzing foot traffic, customer demographics, and transaction volumes. This analysis helps banks make data-driven decisions about branch locations, staffing levels, and service offerings to improve efficiency and customer experience.

- Compliance and Regulatory Reporting: Data analytics helps banks ensure compliance with regulatory requirements by analyzing large volumes of data to identify potential risks, monitor transactions for suspicious activity, and generate accurate regulatory reports in a timely manner.

- Market and Competitive Analysis: Banks use data analytics to analyze market trends, competitor behavior, and customer sentiment to inform strategic decision-making. By leveraging external data sources and advanced analytics techniques, banks can gain insights into market dynamics and identify opportunities for growth.

- Digital Banking Optimization: With the rise of digital banking, banks use data analytics to optimize the digital customer experience. By analyzing user interactions, website traffic, and app usage patterns, banks can identify areas for improvement, personalize the digital experience, and drive customer engagement.

- Predictive Maintenance: Banks rely heavily on technology infrastructure to deliver services efficiently. Predictive analytics helps banks monitor and maintain critical infrastructure, such as ATMs, servers, and networks, by predicting equipment failures before they occur, reducing downtime, and minimizing operational disruptions.

- Route Optimization for sales and distribution/logistics data analytics

- Geographical and Data Analytics for Point of Interest of certain use case

- Area Scoring to determine which area is suitable for certain products category or services, this can be used by sales and marketing department to find out more about target market

- Big Data Tax with Data Analytics Helped enterprise company to manage their Tax data and make sure that they do not overpaid or underpaid the tax collector. this save a lot of money for big enterprises.

- Predictive maintenance : Data Analytics help the maintenance department of any company in making sure equipment and asset is in good conditions and if there is indication that an equipment is about to fail, our solution can help predict it before it happen and can help reduce down time.

- Market Price Analysis and Dynamic Pricing for any type of company that want to make sure always be competitive against the current market pricing

In jakarta and indonesia in general there is many company that need this solutions to help their company grow and be successful in data analyticis.

there is many Bank in jakarta, indonesia that need Credit Risk Assessment / Credit Scoring with machine learning, which can reduce processing time from days into minutes.

there is also many Logistics company in jakarta Indonesia and surabaya, that need Route Optimization to help them to save fuel and increase customer and partner store satisfactions.